Economy

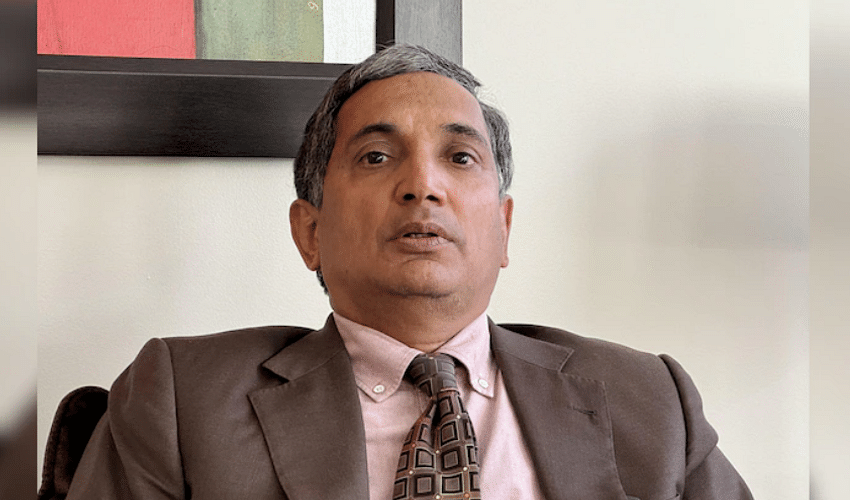

IMF Krishna Srinivasan says private investment in India remains a concern.

Private investment in India continues to be a concern, especially in key sectors like manufacturing and machinery that are essential for boosting productivity, said Krishna Srinivasan, director of the Asia and Pacific department at the IMF, during a press conference. “We remain concerned about the sluggish pace of private investment… For India to achieve developed nation status by 2047, private sector investment must pick up,” Srinivasan emphasized.

On Tuesday, the IMF revised India’s FY26 growth forecast downward by 30 basis points to 6.2%, citing rising global uncertainty and trade tensions in its latest World Economic Outlook. Thomas Helbling, IMF’s deputy director for Asia and Pacific, suggested that India could enhance its growth by embracing trade liberalization, implementing structural and labour reforms, and investing in education and public infrastructure—measures that would facilitate stronger global and regional integration.

The IMF noted that higher tariffs were the main driver behind the reduced growth forecast, even though India remains relatively insulated from global trade shocks. Despite these challenges, the IMF acknowledged that India is making progress in improving public spending efficiency and advancing tax reforms to boost revenue.

Growth in late 2024 was supported by increased exports and consumer spending, the IMF said, but the overall performance was slightly weaker than expected due to a slow rollout of public investment after the elections and other temporary setbacks. Meanwhile, the World Bank also cut its FY26 growth estimate for India to 6.3%, down 0.4 percentage points from its October 2024 projection, pointing to a difficult global landscape. In its South Asia Update, the World Bank said that although monetary easing and streamlined regulations are likely to support private investment, these gains could be offset by global economic headwinds and domestic policy uncertainty.