World

Trump's tax bill help avoid an immediate debt crisis but is expected to worsen long-term financial problems.

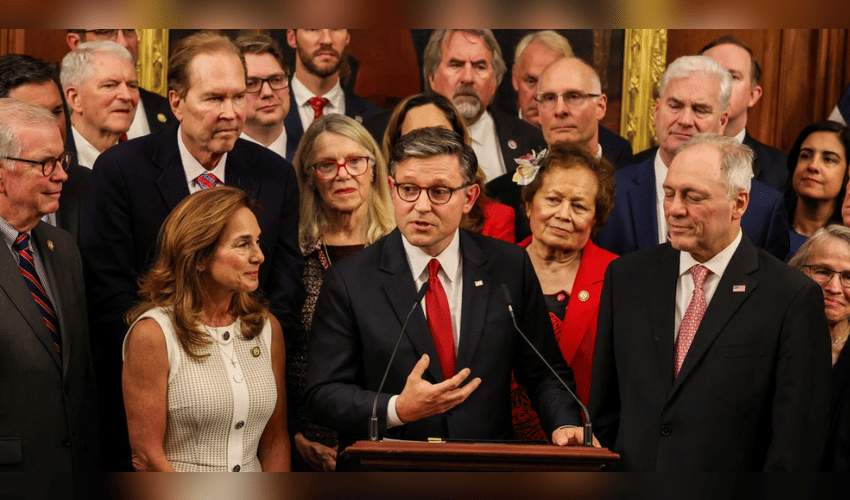

A newly passed tax-cut and spending bill backed by President Donald Trump has temporarily steered the U.S. away from the risk of defaulting on its debt, but experts warn it significantly worsens the country’s long-term fiscal outlook. The bill, approved by House Republicans on July 3, extends Trump's 2017 tax cuts, increases funding for border security and the military, and implements major reductions to Medicare and Medicaid. While it raises the federal borrowing limit by $5 trillion—pushing the cap above the projected $36.1 trillion debt ceiling and avoiding a potential default—it also adds trillions to the national debt. Trump is expected to sign it into law.

This move postpones the "X-date," when the Treasury would no longer be able to fulfill its financial obligations, previously expected around late August or early September. However, fiscal analysts say the bill adds $3.4 trillion in debt over the next decade, straining the U.S. bond market and threatening the nation's financial stability. Analysts like Mike Medeiros from Wellington Management noted that the bill exacerbates long-term concerns about rising deficits, ballooning debt, and inflationary pressure. Investment firm BlackRock also cautioned that foreign interest in U.S. debt is fading, raising fears that demand for the government’s weekly $500 billion in bond issuance could decline—driving up borrowing costs.

According to the Congressional Budget Office, the legislation reduces tax revenue by $4.5 trillion, cuts federal spending by $1.2 trillion, and may cause 10.9 million people to lose federal health insurance coverage over the next ten years. Despite these warnings, the bill contains provisions that stimulate economic growth—such as full deductions for equipment and R&D investments—which could boost corporate earnings and short-term GDP by up to 0.5% next year. Yet many investors are wary that the added debt could eventually dampen this growth.

Some financial experts, including Ellen Hazen from F.L. Putnam, predict the bill may lift equity markets but drive up long-term Treasury yields, reducing the appeal of fixed-income investments. The recent uptick in 10-year Treasury yields suggests growing investor anxiety over fiscal sustainability. Andrew Brenner from National Alliance Capital Markets warned that bond vigilantes—investors who penalize poor fiscal policy by selling off government bonds—are returning, pressuring lawmakers to take deficit reduction more seriously.

While the bill removes the immediate threat of a U.S. debt default by raising the borrowing limit, it has only offered short-term relief. Treasury bill yields due in August had already shown signs of market stress before the bill's passage. Now, analysts expect those yields to settle slightly with the risk of a default diminished. Overall, market response to the bill has been restrained. Investors had already anticipated wider deficits following Trump's reelection, and attention has shifted to concerns over economic performance and interest rate policies. The S&P 500 hit a record high on Wednesday, fueled by tech stock gains and progress on trade deals. However, a surprisingly strong jobs report later cooled expectations of near-term Federal Reserve rate cuts. Robert Pavlik of Dakota Wealth noted that corporate earnings and Fed policy remain the primary market drivers—not the debt bill itself.