Economy

Decoding Economic Survey 2025-26: Five ideas that explain India's economy

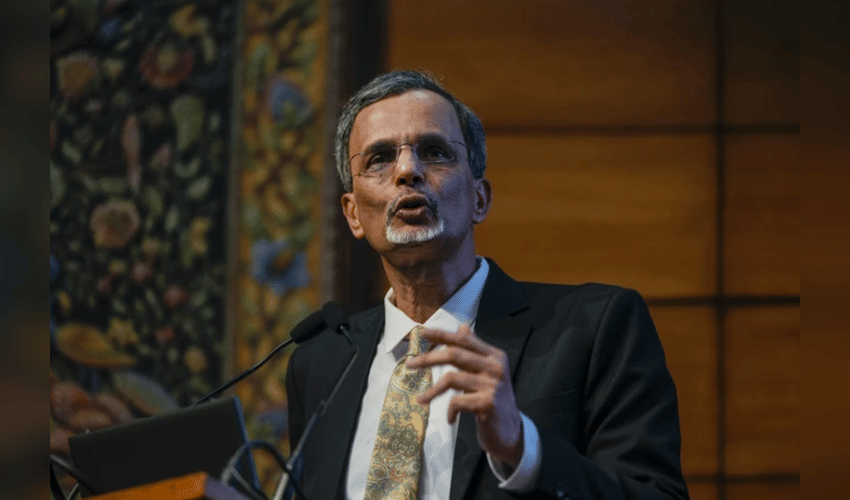

The Economic Survey presented in the Lok Sabha by Finance Minister Nirmala Sitharaman projects India’s economic growth for 2026–27 at between 6.8 and 7.2 per cent. While this estimate broadly matches existing forecasts, the Survey looks beyond numerical targets to grapple with a larger issue: how India should prepare for a global environment marked by rising uncertainty and volatility. Authored by Chief Economic Advisor V Anantha Nageswaran, the document adopts a more cautious, resilience-first approach to growth.

A key argument of the Survey is that low-cost capital cannot be delivered simply through policy actions such as interest rate cuts. Although it is often assumed that reductions in the Reserve Bank of India’s policy rates automatically make borrowing cheaper, this transmission is incomplete in reality, as banks pass on only part of the benefit. More importantly, the Survey stresses that borrowing costs are shaped by investor confidence, which depends on low inflation, currency stability and predictable policymaking. Economies perceived as stable are able to access cheaper capital, while those seen as risky must pay a premium. For India, which still relies on foreign savings and runs current account deficits, the long-term challenge is to move towards generating surpluses, thereby earning lower capital costs in a sustainable manner.

The Survey also highlights the limits of a growth model driven predominantly by services. India’s strength in services exports, particularly in information technology, finance, tourism and hospitality, has supported growth and foreign exchange earnings. However, global shocks such as the Covid-19 pandemic revealed that services alone cannot provide a firm macroeconomic anchor. Manufacturing, the Survey argues, plays this stabilising role by creating large-scale employment, operating on longer-term contracts and generating more predictable export revenues. These features help support currency stability and insulate the economy during periods of external stress.

Another theme running through the Survey is the weakening of the rules-based global economic order. Recent trade measures, including tariffs and penalties imposed by the United States, underline how geopolitical considerations increasingly override economic norms. Similar pressures have been felt across the world, prompting countries to rely more on bilateral and regional trade arrangements. India’s recent trade agreements with the United Kingdom and the European Union reflect this shift. The Survey notes that geopolitics now shapes trade flows as much as economic fundamentals, exposing even well-managed economies to currency volatility and unstable capital movements. In this context, India must prioritise not only growth but also the ability to absorb shocks through adequate buffers, liquidity and redundancy.

The Survey acknowledges business concerns about regulatory complexity, overlapping rules and administrative delays. However, it argues that the answer does not lie in reducing the size of the state but in improving its effectiveness. An entrepreneurial state, as described in the Survey, is one that supports markets, experiments with new approaches, manages risks, absorbs failures and reallocates resources when policies fall short. The emphasis, therefore, shifts from debates over big versus small government to the capacity of the state to implement policies efficiently and adapt to changing circumstances.

The Survey signals a shift in how growth itself is understood. A decade marked by financial crises, pandemics, supply-chain disruptions and geopolitical conflicts has shown that uncertainty is no longer temporary but structural. Against this backdrop, the Survey argues that growth can no longer rely solely on boosting investment or demand. Managing risk has become central to sustaining economic momentum. While the tone remains optimistic, it is tempered by caution, stressing the importance of building buffers that allow the economy to withstand shocks without losing direction.

The Economic Survey delivers a clear message: in a volatile global environment, rapid expansion alone is insufficient. Long-term economic security will depend on resilience, a deeper manufacturing base and capable institutions. Rather than pursuing growth at any cost, the Survey suggests that steady, balanced execution may offer India its most reliable path to sustainable prosperity by 2047.