Politics

Centre's Debt Reaches Rs 185.95 Lakh Crore in 2024-25, Surjewala Calls It "Karznirbhar Bharat"

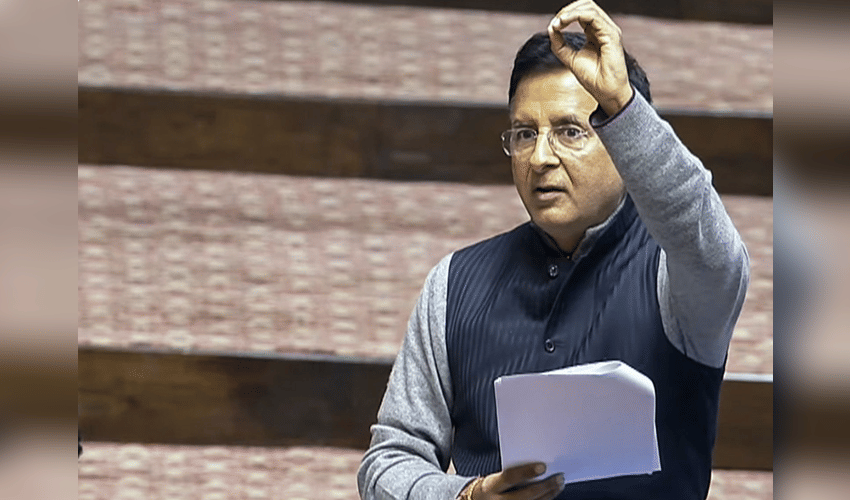

Congress MP Randeep Singh Surjewala on Wednesday highlighted the sharp rise in the Union Government’s debt since 2014, claiming that more than Rs 127 lakh crore has been added over the past decade. Responding to his question in the Rajya Sabha, Minister of State for Finance Pankaj Chaudhary said that the Centre’s total debt for 2024-25 stands at Rs 185.95 lakh crore.

Data from the Finance Ministry shows that the Centre’s internal debt increased from Rs 115.71 lakh crore in 2020-21 to Rs 177.21 lakh crore in 2024-25, while external debt rose from Rs 6.15 lakh crore to Rs 8.74 lakh crore during the same period. Taking aim at the government, Surjewala described the surge in borrowings as an “explosion” and dubbed it “Karznirbhar Bharat.” In a post on X, he noted that central government debt has risen from Rs 58.6 lakh crore as of March 31, 2014, to Rs 185.95 lakh crore in 2024-25, marking an increase of over Rs 127 lakh crore in ten years. He argued that the scale of borrowing contradicts the government’s claims and questioned whether the country has moved from “Atmanirbhar Bharat” to “Karznirbhar Bharat.”

Surjewala also took issue with the debt-to-GDP ratio, which improved to 56.2 percent in 2024-25 from 61.4 percent in 2020-21. He alleged that changes in the calculation method and the post-pandemic GDP rebound have made the ratio appear more favourable. According to him, the absolute rise in debt remains significant despite the improved ratio.

The Economic Survey’s Debt Profile of the Union Government stated that the Centre aims to gradually reduce its debt-to-GDP ratio to around 50 percent. It also noted that about 65 percent of government liabilities consist of marketable securities, such as dated securities and treasury bills. The survey added that this structure has helped government borrowing costs benefit from stable domestic macroeconomic conditions, including easing inflation, steady growth, and supportive liquidity.