News

The Centre has stated that the Companies Act 2013 does not apply to Sikkim.

Published On Wed, 03 Dec 2025

Fatima Hasan

3 Views

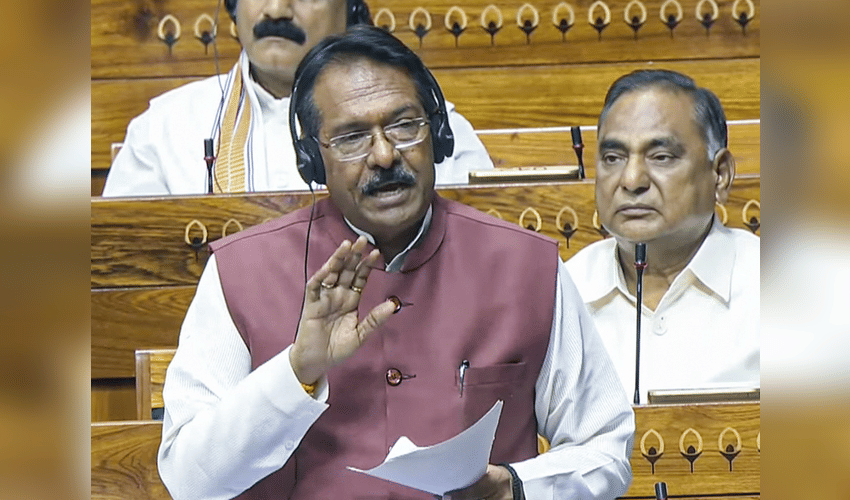

Minister of State for Corporate Affairs Harsh Malhotra clarified that the Companies Act, 2013 does not apply to Sikkim, reaffirming the state’s unique legal position in corporate governance. He was responding to an unstarred question from Rajya Sabha MP D. T. Lepcha, who had raised concerns about challenges faced by Sikkimese stakeholders—such as difficulties in company registration, filing statutory returns, and using the MCA21 portal due to poor connectivity and the absence of facilitation centres in the state.

Lepcha also asked whether the Centre planned to set up a dedicated MCA facilitation centre in Sikkim to support start-ups, MSMEs, and corporate entities, and whether any special exemptions or assistance were being considered. Malhotra replied that since the Companies Act, 2013 is not applicable in Sikkim, the issues raised by the MP “do not arise.”

Separately, the Rajya Sabha returned the Manipur Goods and Services Tax (Second Amendment) Bill, 2025, to the Lok Sabha after a short discussion. The Lok Sabha had passed the amendment on Monday, the opening day of the Winter Session, despite opposition protests demanding a discussion on the Special Intensive Revision of electoral rolls.

During the debate, opposition members walked out over their demand for immediate discussion on the SIR. Finance Minister Nirmala Sitharaman reiterated the government’s commitment to improving ease of doing business and reducing unnecessary disputes. Minister of State for Finance Pankaj Chaudhary had introduced the Manipur GST (Second Amendment) Bill, 2025 in the Rajya Sabha for consideration and return to the Lok Sabha.

Disclaimer: This image is taken from ANI.