Economy

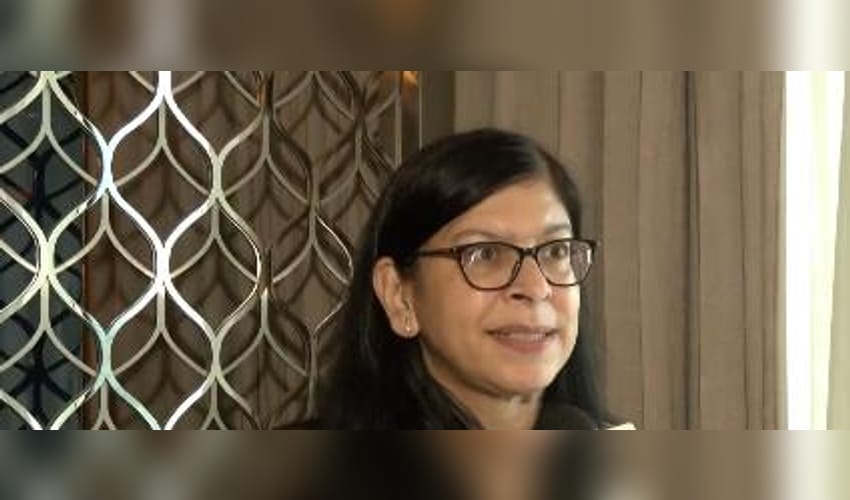

Businesses, high-value payers to benefit most from 'Banking Connect' system: NBBL MD

Published On Thu, 27 Nov 2025

Asian Horizan Network

0 Views

New Delhi, Nov 27 (AHN) 'Banking Connect' will be beneficial for those customers who use digital payments for very high-value transactions, such as businesses making payments for taxes, insurance, and other use cases, Noopur Chaturvedi, Managing Director and CEO of NPCI Bharat BillPay Limited (NBBL), said on Thursday.

Talking to AHN, post the launch of the app, she said that individuals making large-ticket payments, like college fees or investments in stocks or mutual funds, will find it much easier to use for their payment purposes.

"Earlier, they had to remember their IDs, passwords, and the journey was not comfortable for them. Now they can be able to do all these with the comfort of using the application on their phone," Chaturvedi said.

She said that the app is a payment and settlement system that was formally introduced and launched during the Global Fintech Fest (GFF) 2025.

According to Chaturvedi, Net-Banking is the payment stream that the RBI wanted to rewire for years, and now it has been fixed.

"If you go back in time and look at the RBI's Payment Vision 2025, this was one of the payment systems that was fragmented, and the RBI wanted to reimagine and rebuild it again with a central switch," she noted.

The app has been launched as a centralised payment system with its own standard of operation to reimagine net banking, a system that already exists, and it already has 300 million transactions happening every month.

She also said that according to various reports, 80 million customers use net-banking today, and with the ease, these numbers would grow rapidly.

Earlier last month, RBI's Deputy Governor T. Rabi Sankar announced the launch of three key digital payment innovations -- UPI Multi-Signatory, Small Value Transactions using wearable glasses via UPI Lite, and forex on Bharat Connect -- at GFF 2025.

The Multi-Signatory Accounts feature will enable multi-signatory or joint accounts on UPI that require authorisation from one or more signatories to perform UPI payments seamlessly.

Signatories can conveniently use any UPI app to manage linked bank accounts, making the process more convenient and hassle-free, and enhancing transaction speed.

This feature is fully interoperable, allowing initiators to use any UPI or bank apps, while signatories can approve through any UPI or bank app.

The Small Value Transactions using Wearable Glasses via UPI Lite will allow users to complete hands-free and secure transactions by simply scanning a QR, authenticate and complete payments through voice on Smart Glasses, without needing a phone or entering a PIN.

UPI Lite is designed for small-value, high-frequency payments with enhanced success rates and minimal dependency on core banking infrastructure.